Discount Rates, Carbon, and the Ministry for the Future

I recently read The Ministry for the Future by Kim Stanley Robinson. It’s a science fiction novel about climate change in the near future (a.k.a. cli-fi). It is realistic, alarming, and ultimately uplifting and I recommend checking it out.[1] Interestingly (to an evaluator, at least), one of the story’s central concerns was the treatment of discount rates.

“Having debunked the tragedy of the commons, they now were trying to direct our attention to what they called the tragedy of the time horizon. Meaning we can’t imagine the suffering of people of the future, so nothing much gets done on their behalf. What we do now creates damage that hits decades later, so we don’t charge ourselves for it, and the standard approach has been that future generations will be richer and stronger than us and they’ll find solutions to their problems. But by the time they get here, these problems will have become too big to solve. The tragedy of the time horizon is a true tragedy because many of the worst climate impacts will be irreversible. Extinctions and ocean warming can’t be fixed no matter how much money future people have, so economics as practiced misses a fundamental aspect of reality.” - The Ministry for the Future by Kim Stanley RobinsonCharacters in the book discuss that in order to figure out how to decide which projects to fund with limited resources, one must discount future money and future generations. “If you rate all future humans as having equal value to us alive now,” one character explains, “they become kind of infinity, whereas we’re finite. If we were working for them as well as ourselves, then we should be doing everything for them. Every good project would be rated as infinitely good, thus equal to all good projects.” Consequently, we need to discount the future to make decisions.

“So given that, how do you pick a discount rate?” the main character asks.

“Out of a hat,” the first character replies. “There’s nothing scientific about it. You just pick one.”

A Primer on Discount Rates

The underlying idea behind discount rates is the time value of money: a dollar today is more valuable than a dollar in the future because of the opportunity costs associated with the wait, typically thought of in terms of the foregone interest that could be earned if that money were invested. For example, if someone had the option of receiving $100 today or $100 a year from now, they would choose it today because they could invest it and, for an example 5% interest rate, get $105 in a year. Because of this, receiving $100 in a year is equivalent to opting for $95.24; its discounted present value, today.

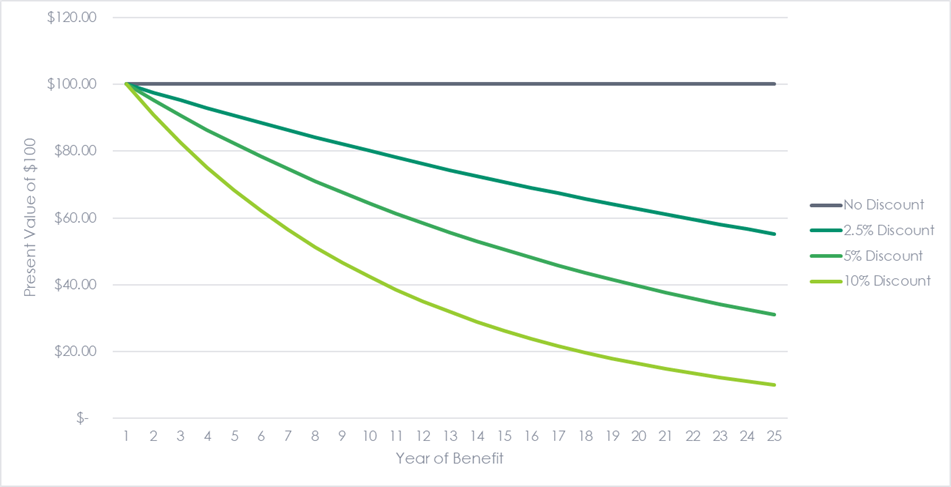

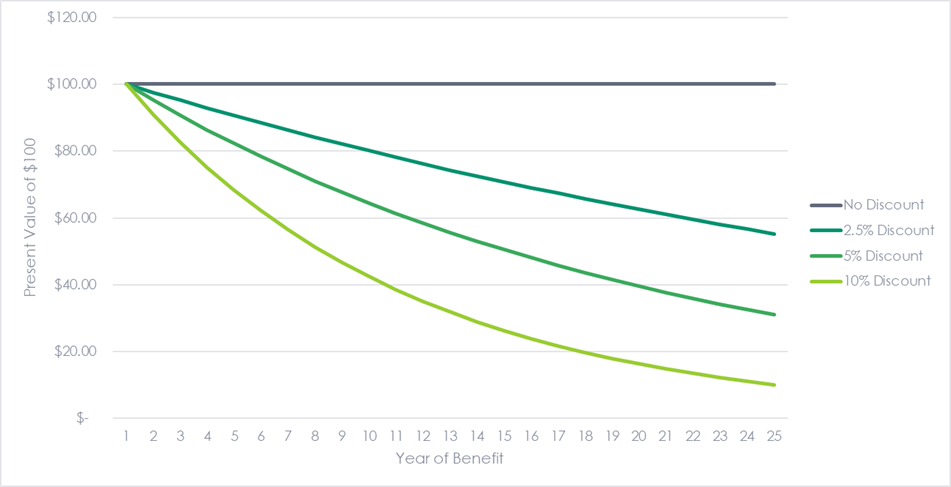

As shown in the figure below, the higher the discount rate, the less valuable future dollars are in present value dollars. Assuming a 5% discount rate, $100 in five years has a present value of $64.46. The present value is only $42.41 in five years with a 10% discount rate.

Because costs and benefits are realized at different times, they are not directly comparable. Applying a discount rate is required to understand these values in present terms and compare them to make decisions.

In cost-effectiveness testing, we compare the net present value of the benefits of an energy-efficient measure with the net present value of its costs. Let’s assume, like the figure above, a measure has annual energy savings of $100, a one-time cost of $1,250 to install in the first year, and lasts for 25 years. The benefit-cost ratio can vary from 2.0 if no discount rate is used to 0.8 (i.e., not cost-effective) if a 10% rate is used.

The discount rate used in these benefit/cost calculations expresses the relative importance of short-term benefits and costs relative to long-term benefits and costs. The higher the discount rate, the more the calculation will favor short-term investments because of the low value of future dollars.

The National Standard Practice Manual describes best practices for using discount rates in cost-effectiveness analyses. Most importantly, the discount rate used should reflect the perspective of the test and the time preference of the decision-maker. The opportunity cost of money or cost to borrow is different for a business, a family, and a government as is their time preference. For example, the discount rate used by a program participant would likely be their opportunity cost of money, likely represented by their cost of borrowing or opportunity costs of other investments. Utilities often use their weighted average cost of capital (WACC) as the discount rate for utility cost tests. From the societal perspective, a low-risk societal cost of capital, such as the interest rate of a 10-year US Treasury Bond, is often used.

When deciding on the appropriate discount rate for long-term societal impacts, a government or regulator should keep in mind overarching policy goals, future customer interest, and intergenerational equity and therefore should place a higher value on long-term benefits (i.e., use a lower discount rate). Similarly, discount rates are often associated with the cost of capital, but utilities also need to consider policy goals and serving their customers over the long term, so only using the WACC as the discount rate may not be the best choice.

Adding Greenhouse Gases to the Equation

According to NASA, CO2 lasts in the atmosphere between 300 and 1,000 years, which is longer than most of us and our heat pumps will be around. The benefits of efficiency and decarbonization last much longer than the expected life of the installed equipment.

To account for the future harm created by the release of one additional ton of CO2 into the atmosphere, we need to establish a social cost of carbon. This value represents the estimated future damage of a ton of CO2 released today in present dollars. The Biden administration recently set an interim social cost of carbon of $51 per ton, to be updated pending more comprehensive research.[2] This value will rise to $85 per ton by 2050 as damage from climate change is expected to progress. This compares from $1 to $7 under Trump, who only calculated the damages to the US, not the world (and used a higher discount rate).

As we have seen earlier, the discount rate used to value future costs and benefits is extremely important, especially for longer timelines like the effect of CO2 in the atmosphere. A lower discount rate will result in a higher social cost of carbon because more importance will be placed on future benefits rather than present benefits (avoiding spending money).

The new social cost of capital was calculated using a 3% discount rate. This means that to save $100 in damages a century from now, we are willing to spend $5.36. Many believe that this discount rate is too high and a lower discount rate (and therefore higher social cost of carbon) is needed for benefit/cost analyses to truly encourage decisions to be made with CO2 and climate change in mind.

Interestingly, the 3% discount rate used is a holdover from the George W. Bush administration. This value was chosen to standardize all government cost-effectiveness analyses because it was the approximate value of the yield of a 10-year US Treasury bond at the time. This rate should be reevaluated for many reasons, primarily because the time perspective of CO2 and climate change is much longer than 10 years, but also because the yield of these bonds has ranged from 0.51% to 1.75% over the past year; well below 3%.

Are We Doing This Right?

When calculating the cost-effectiveness of energy efficiency programs at the societal level, we need to include the avoided cost of carbon as well as other non-electric and non-energy benefits (e.g., water savings, delivered fuel savings, O&M savings, etc.) Typically, all these benefits are monetized and added to the avoided costs of capacity and energy to create an annual benefit in dollars. This is then discounted and summed, resulting in the net present value of benefits.

In writing this post, I realized we may be doing something wrong. Typically, these tests include a $/MWh adder to account for the harm of carbon that is not already captured in other avoided costs (like compliance with RGGI). This adder is based on the tons of CO2 emitted from generating the electricity given that utility’s generation mix and the time of generation. But if this value is based on the social cost of carbon, then the cost of carbon is already being discounted. By rolling this value up as a simple adder to the avoided costs, then we are likely double discounting it. The cost of carbon value can not be treated like water savings or other fuel savings because each of those will have forecasted values into the future based on expected changes in the market. Each of those values is a single point in time not a discounted present value of future benefits. Something to think about…

Fun with Discount Rates

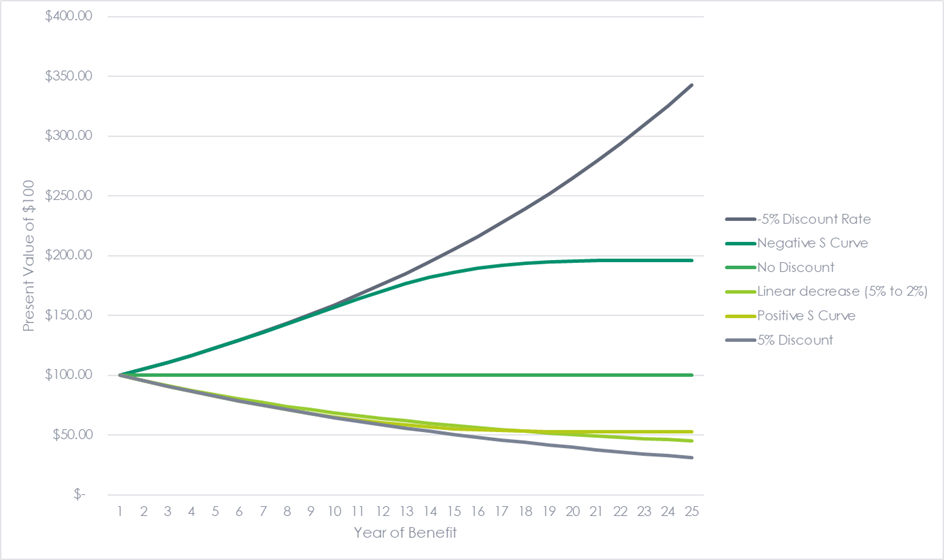

I found it interesting that in the book, Robinson did not just discuss the level of the discount rate, but its shape as well. As described in the introduction to this post, we need some way to discount the future to decide how to allocate resources, but the discount rate does not need to fall into the typical range of 2% to 8% or to even remain the same over time.

Some ideas:

- Negative rate – we may regard the effects of greenhouse gases to be so important that we should use a negative discount rate, which would make a future dollar worth more than a dollar today.

- Linear decreasing rate – we may decide that a higher discount rate is appropriate for short-term investments while a lower rate is better for long-term investments. Therefore, we may decide to decrease the rate (linearly) over time, perhaps starting at 5% in year 1 before reaching 2% in year 25 and beyond.

- S-shaped curve decreasing rate – similar to the linear decreasing rate but using a sigmoid function

- S-shaped curve increasing rate – maybe we try increasing the rate over time?

The figure below illustrates these examples. If, as the book says in the excerpt above, we are just picking discount rates out of a hat, then we should pick one that best aligns with our goals, whether they are political, economic, societal, or ethical.

[1] Some other climate-related recommendations: The Southern Reach Trilogy by Jeff VanderMeer, A Children’s Bible by Lydia Millet, and All We Can Save edited by Ayana Elizabeth Johnson and Katherine K. Wilkinson (nonfiction).

[2] Societal costs of methane ($1,500/ton) and nitrous oxide ($18,000/ton) were also set.